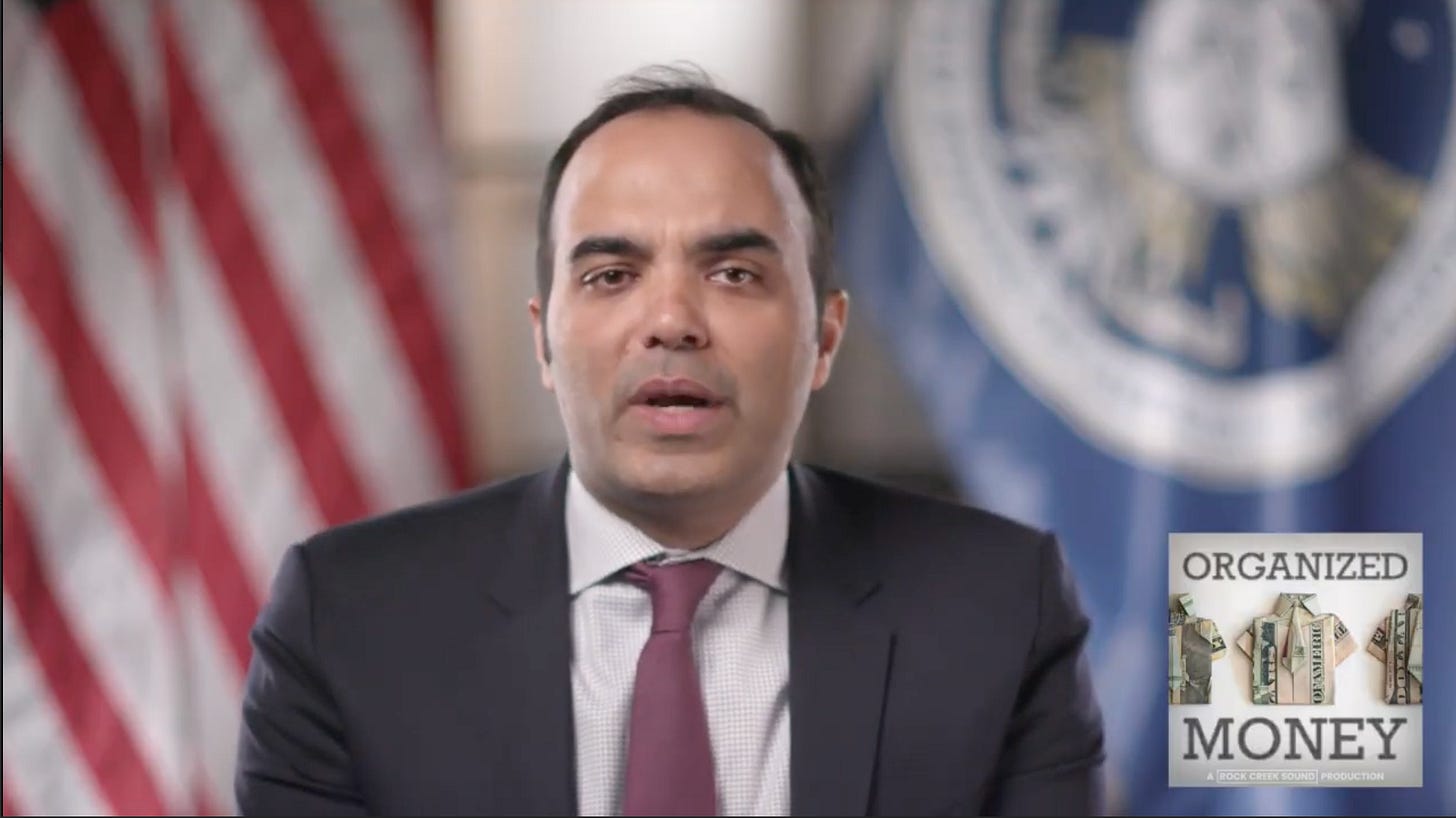

Episode #12: Why Wall Street Loves Junk Fees with CFPB Director Rohit Chopra

Wall Street's biggest players have a nemesis: Rohit Chopra, the head of the Consumer Financial Protection Bureau. Chopra revived antitrust and bank regulations, and coined the term 'junk fee.'

Welcome to the podcast Organized Money. You can listen to today’s episode with CFPB Director Rohit Chopra on Apple, on Spotify, or wherever you get your podcasts.

In the 1760s, a frustrated group of colonists in Western North Carolina, calling themselves ‘regulators,’ attacked the sheriffs and bankers coming to take their farms in foreclosure, a foreshadowing of the American Revolution that would come just a few years later. This ‘War of the Regulation,’ as it was known, inspired everyone from the Whisky Rebels to Franklin Delano Roosevelt in the New Deal.

This conflict continues today, with a bitter fight between Wall Street and those who try to craft rules to constrain big finance. Today we speak with Rohit Chopra, who is perhaps the most hated man on Wall Street. As head of the Consumer Financial Protection Bureau, an agency created during the financial crisis to better regulate personal financial services, this Wharton MBA-turned regulator Chopra has changed America in three fundamental ways. First, in the 2010s, he attacked the student debt problem, then he revived monopolization law, and now seeks to force banks to compete instead of cheat.

Unlike most D.C. types, Chopra is not shy about the conflict. “Today,” said Chopra in a speech at Wharton on corporate lawbreaking, “my classmates, students, and other alumni are now financiers, convicted felons, and everything in between.” Of course, he has powerful enemies. Tech billionaire Marc Andreessen claims Chopra is “terrorizing” banks and pushing them to cut off services to people based on politics.

In this episode, Chopra sits down with Matt and David to explain the role of regulation in business, and how CFPB is actually fighting to make sure banks can’t discriminate against anyone, while preventing powerful actors from rigging the financial system in their favor.

Listen via Apple:

Or Spotify, or wherever you get your podcasts.

Letters to the Podcast

Since we did our episode on the ‘Vice Monopolists’ - Fanduel and DraftKings, a bipartisan pair of Senators sent a letter to the Federal Trade Commission asking for an investigation of the two companies for actions that “obstruct or impair competition.” There are smaller gambling firms upset at the dominance of the duopoly, but there is also a broader anger at the prevalence of predatory gambling in American life.

That said, there are proponents of legalized predatory gambling, and it’s always useful to hear the other side of the argument. One of our listeners is Peter Schoenke, the co-founder and President of RotoWire.com, a fantasy sports information service that includes betting information. He’s also the former chairman and current chair of government affairs for the Fantasy Sports & Gaming Association. The members of FSGA include FanDuel and DraftKings, as well as corporations on the other side of the antitrust fight.

Schoenke took issue with our episode on sports gambling, and penned a response. We’ve included it below. You can give us your feedback on our episodes in the comments or by responding directly to this email.

The recent podcast “Episode #9: Vice Monopolists FanDuel and DraftKings with Les Bernal and Dr. Kavita Fischer” was very one sided in its view of sports betting and had little to do with monopoly or organized money.

First, there’s a compelling case for the legalization of sports betting which was given little or no voice during the episode. Sports betting was happening before the repeal of the Professional and Amateur Sports Protection Act in May, 2018 with estimates that U.S. residents wagered approximately $150 billion each year through offshore illegal sportsbook websites. Illegal offshore sportsbooks are still easily available across the U.S. today, along with local bookies. Thirty eight states have regulated sports betting today, leaving the remaining twelve with only illegal options.

Without a legal option, consumers are easily taken advantage of. Illegal sportsbooks don’t have to adhere to any consumer protection measures. There’s no recourse if a customer isn’t paid winnings or not allowed to withdraw funds. Illegal sportsbooks can mercilessly take advantage of problem gamblers as they don’t have to follow any Responsible Gambling requirements. The FBI has noted that illegal sports betting is a favored tool for money laundering by organized crime organizations and has warned of the risks of identity theft associated with providing personal information to unregulated gaming websites.

It's better to bring the activity into the light, regulate the industry so consumers are protected and tax the industry to pay for regulators and provide funds to help problem gamblers. Sports betting laws also need to provide for online sports betting as over 90% of wagers are made online in states that allow mobile sports betting. Consumers want the convenience of betting on their mobile devices and have shown they’ll bet with illegal sportsbooks rather than travel to a physical location.

Second, there was little comparison to how legal sports betting has worked in other countries. When this podcast talks about other industries, comparisons are frequently made about how the market in the US differs from those other countries. Online sports betting has been legal in the United Kingdom since 2005. A 2023 NHS Health Survey for England estimated that 0.4 per cent of the adult population are problem gamblers. While ideally that rate would be zero, the UK rate has remained fairly steady the past two decades. The issues of problem gambling have not spiraled out of control in the UK and Europe like the brief comment in the podcast would appear to indicate. The lesson from the UK and other European countries is that online sports betting and even igaming can be regulated and managed as an acceptable form of entertainment – even though there needs to be continued vigilance among regulators to address any problems.

Lastly, the episode didn’t really address the topic of monopoly or market power. FanDuel and DraftKings have the largest market share, but they didn’t arrive there due to monopoly tactics. They did not achieve their scale by rolling up competitors. The state-sponsored gambling monopolies, namely state lotteries and limited casino licensing, existed long before FanDuel and DraftKings were founded. The gambling landscape in the U.S. is unique to each individual state that required a more nuanced look than the podcast provided, and involves factors like Tribal gaming (Hard Rock, owned by the Seminole tribe, for example, has a state-sponsored monopoly on sports betting in Florida). Furthermore, the legal sportsbooks in the US are limited in their ability to raise prices by the presence of robust competition: the untaxed illegal offshore market.

While the trade group I represent has both FanDuel and DraftKings as members, The FSGA has been very anti-monopoly. The fantasy sports hobby largely exists and has thrived due to a key court case supported by the FSGA in 2006 against MLB that stopped it from monopolizing the industry. The FSGA advocates for sports betting laws with low entry fees and expansive licensing like Arizona, Tennessee and New Jersey.

Sports betting laws and regulations are relatively new in most states and there’s always room for improvement, but a full picture of the industry shows the large benefits for consumers and state governments.

He should become a teacher after he retires from government because he speaks so nice and slowly, concisely getting to the point.

Thanks for the playable link of the podcast. I don't have apple or Spotify.