The AI Bubble: More Subprime Than Dot Com

Veteran Wall Street reporter Herb Greenberg joins to discuss the AI bubble and the history of hyper-inflated markets.

Welcome to the podcast Organized Money. You can listen to today’s episode on Apple on Spotify, or wherever you get your podcasts.

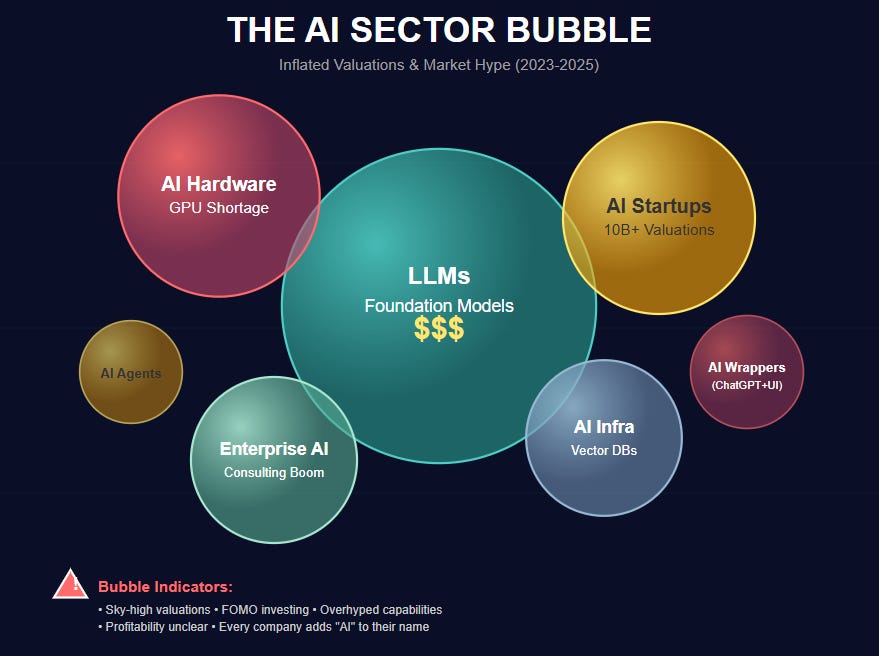

Investment in AI infrastructure has exploded over the last few years, with big players like Google, Meta, OpenAI, Nvidia, and Oracle, striking deals involving hundreds of billions of dollars to build out AI data centers. These deals are single-handedly buoying the otherwise-flailing US economy, but where are these billions actually coming from? And why do all these deals seem to involve the same players in increasingly circular arrangements? Even the most optimistic observers are starting to state the obvious: we’re in an AI bubble.

Image Created using Claude.ai “Create a jpg depicting the AI Sector Bubble“

Today on the show, Matt and David talk to Herb Greenberg of Herb Greenberg’s Red Flag Alerts to discuss the hubris of the current moment, how this moment is both alike and different from past bubbles, and how this thing might pop.

Listen via Apple or Spotify, or wherever you get your podcasts.

Another thing we’re doing this year is providing transcripts and video for every episode. Check your inbox for that soon.

Thank you so much for listening. If there’s a monopoly you’d like us to explore this year, or if you have anything else to tell us, please let us know by leaving a comment or by responding directly to this email.

Maybe a bubble but the effect of AI on tech productivity is real and exploding right now with things like Claude.

IT historical bottleneck is proper senior developers who comprise less than 1% of the lot and whose time is hugely wasted.

Now we have these new assistants which learn and follow instructions better than millions of contractors we have been forced to carry for years...

Things may change abruptly.

There is too much money in the economy. I know some of it comes from the Fed and some comes from the trade deficit.

While there are many progressive programs that I would like the United States to pursue, politicians and capital aren't interested. And, random conspiracy theories are never going to coalesce into a coherent program that makes the most out of what the American people have to offer.

And, so, it seems clear that our economy can't do anything productive with all the easy money floating around out there.

Matt asked how to burst the bubble. We need to do two things. One, we need to take the excess money out of the economy. It is just making our economy more precarious without solving any real problems. Two, every ten years we have another crisis. And, the Fed Chair shoots a money nuke out the window of the Eccles Building. Instead, we need to think about what problems we're trying to solve with quantitative easing and address those directly instead. The banking reforms in Europe after 2008 come to mind. What if we brought 'bail-in' to the US?

In part, I'm skeptical of a 2% inflation target because the money supply that goes along with that just seems to create more buybacks and private equity firms. I guess I need to find out what a liquidity trap is.