Video and Transcript for The AI Bubble: More Subprime Than Dot Com

The current AI wave has sent public and private assets parabolic recently. This week we find out exactly why, and theorize how it might end, if it does.

Below you can find a YouTube post of the recording for Episode #51, The AI Bubble: More Subprime Than Dot Com.

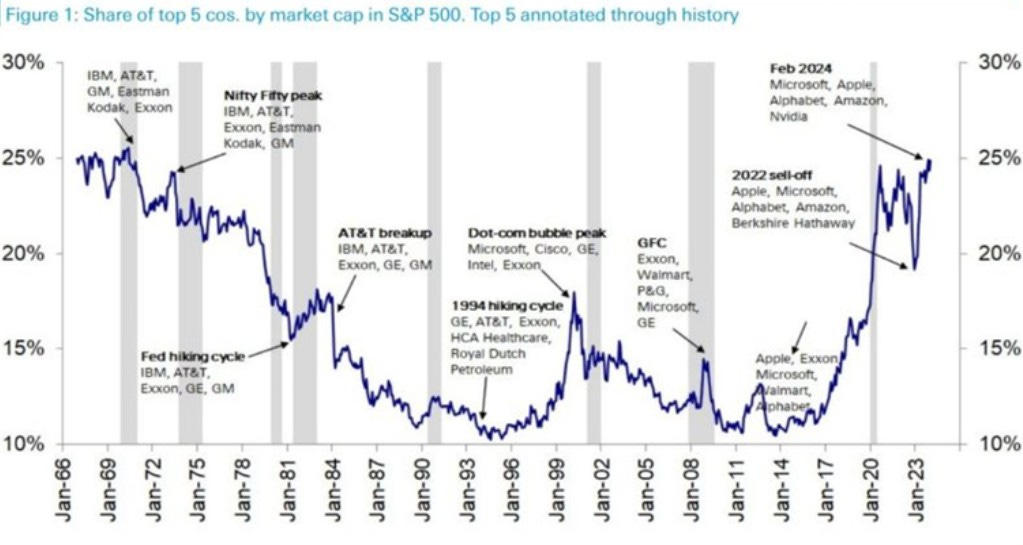

Graphic from Deutsche Bank

Tulips in 17th century Europe, railroads in 19th century America to the 1929 stock market crash induced depression, Japanese real estate in the 80s, Pets.com, Collateralized Debt Obligations, and now the AI buildout; bubbles are eternal in capitalized markets. Guest Herb Greenberg is an expert on the phenomenon and has been covering these and other economic topics for decades.

He joins to discuss the current state of the AI bubble (acknowledged by participants), why and how bubbles happen with a focus on this one, and how he would choose to “pop” this current market bubble.

This is not as heavily edited as the podcast, it’s closer to the raw video of our taping session. We also have a rough transcript for you.

We have set up a YouTube channel that you can subscribe to for all future episodes.

Thanks for watching the show! We’ll have another one for you soon.

Good interview. Way more questions raised than answered, but that appears to be the nature of this bubble. We learned that historical anecdotes do not quite fit the pattern with AI especially given the sums of money involved in its buildout. The interview did produce cringy news: some of the crew from the housing bubble are back, brushing off their securitization playbooks.